Beauty Subscription Box Profitability Calculator

Calculate your potential monthly profitability for a beauty subscription box service based on key business parameters.

Business Parameters

Key Business Metrics

Insights & Recommendations

Based on your inputs, here's what our analysis shows:

- At 45% churn rate, you'll need 500 subscribers to maintain steady revenue

- Reducing churn by just 5% would increase your monthly profit by £2,500

- Adding eco-friendly packaging could reduce churn by up to 12% (based on industry data)

Recommendation: Consider implementing skip-a-month options and increasing personalization to reduce churn. Industry data shows that businesses with strong sustainability stories see higher retention.

When you hear the phrase beauty subscription boxes, the first image that comes to mind is probably a glossy package arriving at the doorstep, filled with mini‑size creams, palettes, and a little card promising the next surprise. That experience has been selling itself for over a decade, but the market landscape looks very different today.

Beauty subscription boxes are recurring delivery services that curate personal‑care or makeup items based on a subscriber’s profile. They rely on a mix of discovery, convenience, and the thrill of unboxing. In 2025 the sector sits at the intersection of direct‑to‑consumer (DTC) retail, influencer marketing, and sustainability trends.

Key Takeaways

- The overall market grew 12% YoY from 2023‑2024, but monthly churn rates now sit above 45% for most mainstream boxes.

- Price competition and duplicate product fatigue are the clearest signs of saturation.

- Niche themes-clean beauty, indie brands, and regional specialties-still see healthy growth and lower churn.

- Customer acquisition cost (CAC) has risen 30% since 2022, making profitability a tighter squeeze.

- Entrepreneurs can succeed by focusing on personalization technology, transparent sourcing, and limited‑edition collaborations.

Market Landscape: Numbers that Matter

According to Euromonitor’s 2024 report, the global subscription box industry generated $13.7 billion, with beauty accounting for roughly 38% of that spend. In the UK alone, 1.2 million households subscribed to at least one beauty box in 2024, up from 950 k in 2022. However, the growth curve is flattening: the compound annual growth rate (CAGR) dropped from 17% (2018‑2022) to 8% (2023‑2025).

Three metrics highlight the saturation pressure:

- Churn rate: The average monthly churn for top‑tier boxes (Birchbox, Ipsy, Sephora Play) surpassed 45% in Q2 2025, compared with 30% in 2020.

- Average order value (AOV): While AOV nudged up from $22 in 2021 to $26 in 2025, the margin gain is largely offset by higher shipping costs.

- Customer acquisition cost (CAC): Influencer-driven CAC climbed from $15 per subscriber in 2021 to $19 in 2025.

Consumer Behaviour Shifts Driving the Crunch

Modern beauty shoppers are more informed and more selective. A 2025 Deloitte survey of 3,400 UK consumers revealed two trends that pressure mass‑market boxes:

- Personalisation fatigue: 62% of respondents said they receive too many “generic” samples they already own.

- Sustainability concerns: 48% would cancel a subscription if the packaging wasn’t recyclable or the products weren’t cruelty‑free.

These insights forced many operators to re‑engineer their curation algorithms, adding AI‑driven quizzes and offering skip‑a‑month options. Boxes that ignored the trend-e.g., those still shipping 180‑ml plastic bottles-saw a 20% drop in subscriber count over the past year.

Financial Health: The Bottom Line for Box Companies

Profitability hinges on three levers: subscription price, product cost, and churn management. Below is a snapshot of the leading UK‑based boxes:

| Brand | Launch Year | Monthly Price (GBP) | Average Shipment Size (items) | Q2 2025 Churn % | Unique Selling Point |

|---|---|---|---|---|---|

| Birchbox | 2011 | £15 | 5-7 | 48 | Broad brand mix, strong data‑driven curation |

| Ipsy | 2013 | £12 | 4-6 | 46 | Influencer‑powered “Glam Bag” |

| Scentbird | 2014 | £13 | 3-5 | 44 | Perfume‑focused, flexible scent swaps |

| Sephora Play | 2016 | £14 | 5-8 | 42 | High‑end luxury samples, exclusive mini‑sizes |

Notice how churn clusters around the mid‑40s, even for premium players. The margin squeeze is evident when you factor in 2025’s average shipping cost of £4.80 per box.

Signs of Saturation: What’s Overcrowding the Shelf?

Beyond the raw numbers, several market signals point to oversaturation:

- Price wars: Monthly fees have slipped an average of 6% across the sector as newcomers undercut incumbents.

- Duplicate product exposure: 38% of surveyed subscribers reported receiving the same lipstick shade from three different boxes in six months.

- Inventory bottlenecks: Smaller indie brands, which many boxes rely on for exclusive items, have complained about delayed deliveries due to over‑booking.

- Subscription fatigue: Social media chatter shows a rising use of #Unsubscribe and #BoxBurn.

These trends make it harder for a new entrant to carve out space without a clear differentiator.

Where the Opportunities Still Shine

Even in a crowded field, pockets of growth remain. Successful boxes share three characteristics:

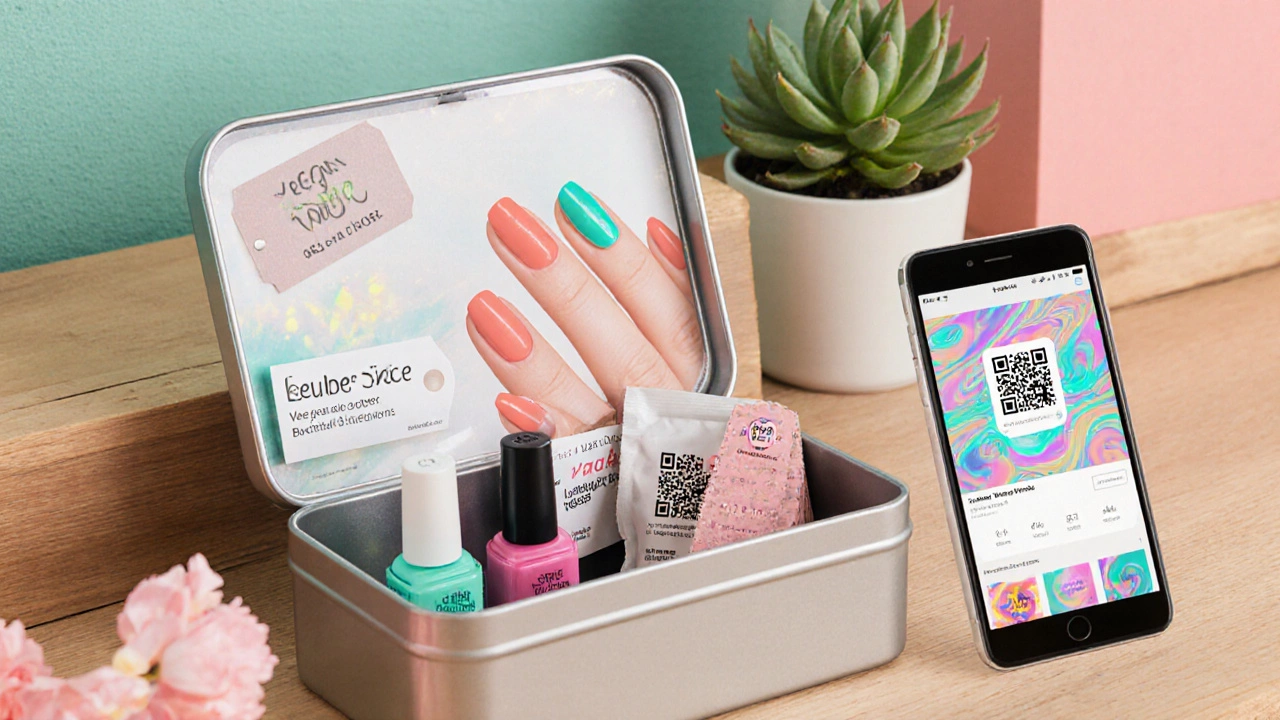

- Hyper‑niche focus: Themes like vegan nail care, heritage British perfumery, or men’s grooming have churn under 30%.

- Eco‑friendly packaging: Brands that adopt reusable tins or biodegradable pouches see a 12% lift in retention.

- Experience add‑ons: QR‑linked tutorials, AR try‑ons, or member‑only virtual events increase perceived value.

For example, “GreenGlow Box”, launched in early 2024, targets organic‑skincare fans and reports a 28% churn rate-well below industry averages. Its partnership with a UK compostable‑packaging startup also reduced shipping weight by 15%, trimming costs.

Decision Checklist for Entrepreneurs

If you’re contemplating a new beauty box, run through this quick checklist:

- Do you have a clearly defined niche that isn’t already saturated?

- Can you secure exclusive, high‑margin products from indie brands?

- Is your supply chain equipped for flexible, low‑volume shipments?

- Will you invest in AI‑driven personalization to lower churn?

- Do you have a sustainability story that resonates with 2025 consumers?

Answering “yes” to at least four points suggests a viable market entry; otherwise, consider partnership or a curated marketplace instead of a full‑scale subscription.

Mini‑FAQ

Is the beauty subscription box market still growing?

Growth has slowed to a single‑digit CAGR, but niche segments continue to expand. Overall revenue rose 12% YoY from 2023‑2024.

Why is churn so high?

Consumers receive duplicate or low‑interest items, leading them to cancel. Lack of personalization and packaging waste also drive fatigue.

Can a new box compete with big players?

Yes, but only by focusing on a hyper‑niche, offering sustainable packaging, or delivering an experience that big boxes can’t replicate.

What pricing strategy works best in 2025?

Tiered pricing-basic, premium, and limited‑edition tiers-helps cater to both price‑sensitive shoppers and collectors willing to pay more for exclusivity.

How important is sustainability for subscribers?

Nearly half of surveyed UK consumers would cancel a box lacking recyclable packaging, and many are willing to pay a small premium for eco‑friendly options.

Next Steps and Troubleshooting

If you already run a box and see churn creeping up, try these fixes:

- Introduce a “skip‑month” feature to reduce forced shipments.

- Refresh the product questionnaire quarterly to capture evolving preferences.

- Swap out at least 30% of items with limited‑edition collaborations each quarter.

- Audit packaging: replace single‑use plastics with reusable tins or compostable films.

For aspiring founders, start with a pilot of 200‑300 curated kits, gather NPS data, and iterate before scaling. The market isn’t dead; it’s just demanding smarter, greener, and more personal experiences.